Romanians worked to pay their dues to the state until June 19, and only after this date did they start working for themselves, according to calculations made by the Molinari Economic Institute. This is because the burden of taxes weighs heavily on their shoulders: out of 100 lei, only 53.68 lei remain in their pockets after paying their taxes owed.

Urmărește mai jos producțiile video ale Economedia:

- articolul continuă mai jos -

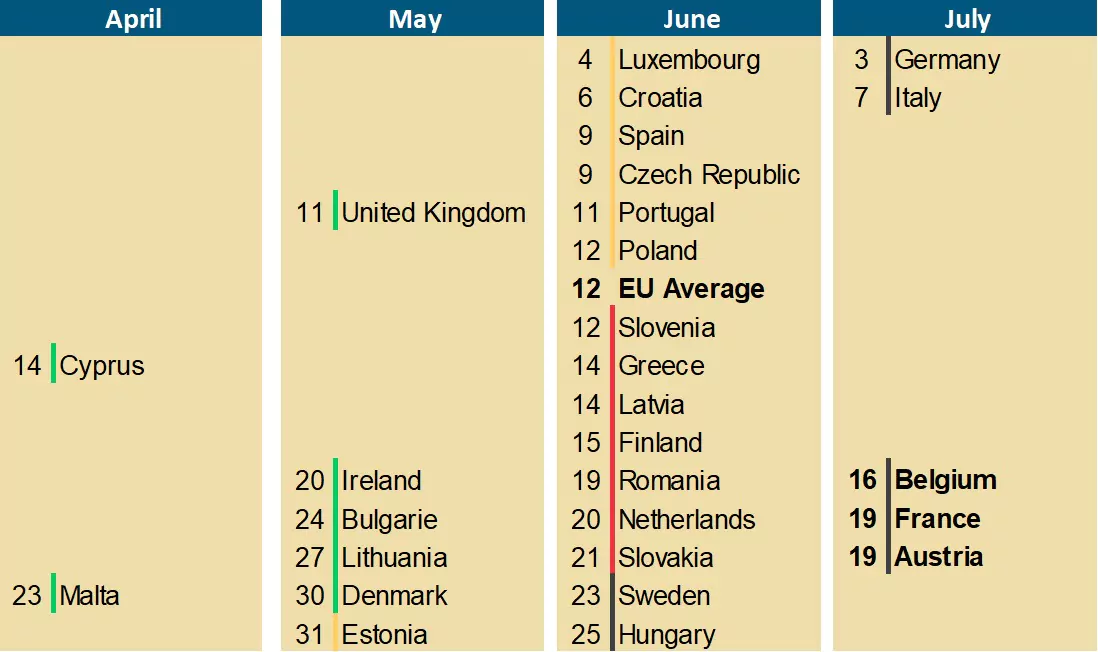

June 19 is therefore the day of fiscal freedom for Romanian employees. The Molinari Institute calculated the number of days a Romanian employee with an average salary must work to pay his or her own contributions to the state in order to calculate the tax burden. The day of the year in which he/she will finish paying off the taxes was called the “day of fiscal freedom”.

Only to pay the taxes to the state for a year, which accumulates 46.32% of the income, Romanians work until June 19 of that year. Only after this date do they work for themselves and get rid of the burden of taxes owed to the state. For the last four years, the day of fiscal freedom for a Romanian has remained constant, on June 19.

This date places us in 19th place in the EU in the ranking of fiscal freedom, down two positions from last year, when we were in 17th place.

Cyprus and Malta pay their taxes to the state the fastest on April 14 and 23, followed by the United Kingdom, Ireland, Bulgaria, Lithuania, Denmark and Estonia on May 11, 20, 24, 27, 30 and 31 respectively. Residents of Belgium, France and Austria pay the most taxes to the state on July 16 and 19, respectively.

Top salaries and taxation

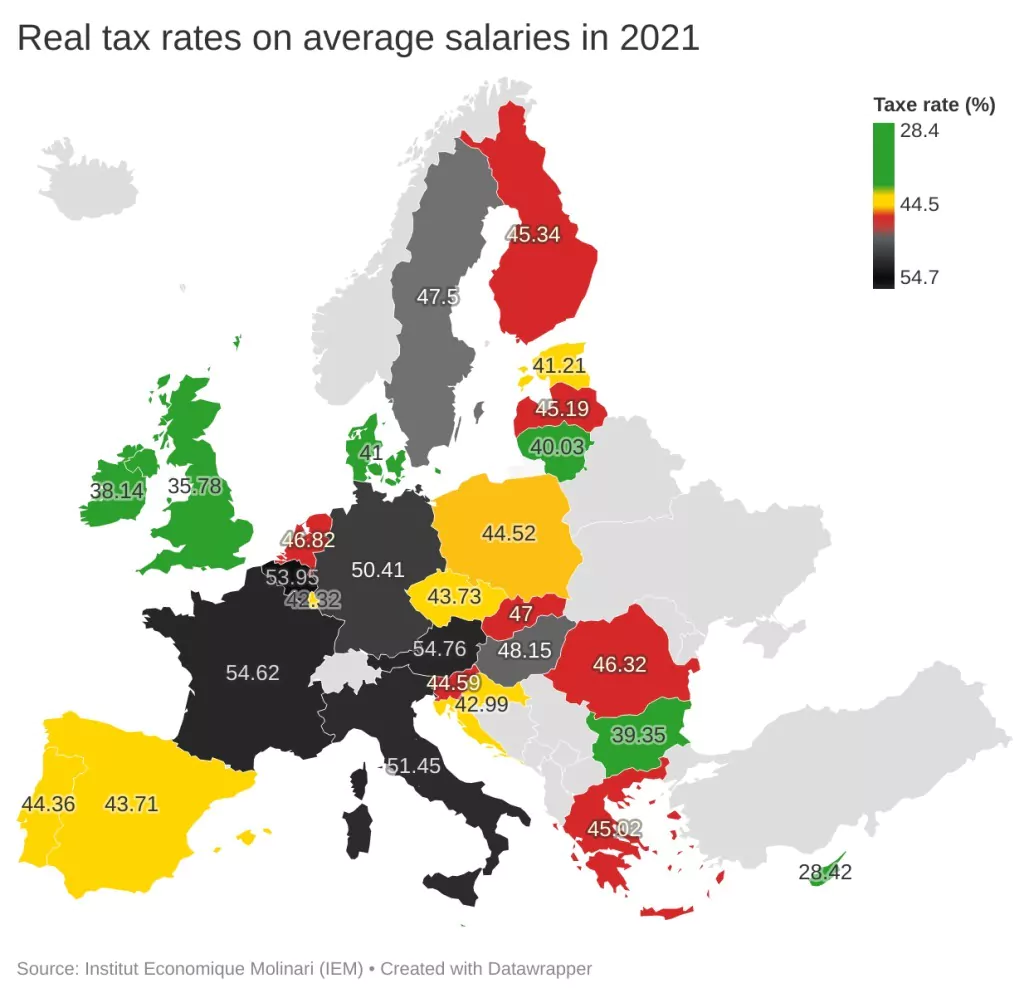

The average gross salary in the European Union varies considerably, from less than 10,000 euros per year in Bulgaria to almost 70,000 euros per year in Luxembourg. But the taxation (income tax and VAT) also goes from 27% to almost 55%.

For example, a Luxembourg residents have the highest salary in the EU, 69,758 euros (68,510 euros last year), while the tax rate is only 42.32%, leaving them with one of the highest net salaries in the EU. , in an absolute amount of 40,234 euros (compared to 39,641 euros last year).

A Romanian receives the second lowest annual salary in the EU, of 12,783 euros (compared to 11,526 euros, last year) and is taxed with 46.32% of this income, which leaves him the second lowest income available, in absolute amount of 6,862 euros (compared to 6,187 euros last year).

The lowest salaries in the EU are in Bulgaria, where an employee earns 9,244 euros annually on average, is taxed at 39.35% and remains with 5,607 euros.

The cost of the employer to pay an employee 1 euro

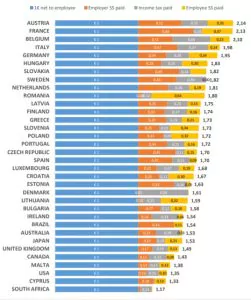

The Molinari Institute also analyzed how much it costs an employer so that the employee receives 1 euro in his hand.

In the case of Romania, the employer will have to pay 1.8 euros out of pocket (compared to 1.75 euros last year), so that the employee’s net salary is 1 euro. Romania is at the top of the ranking, with one of the highest costs. It should be noted that Romania is the only country where most of the tax burden is placed on the employee’s shoulders.

The top is led by Austria, where it costs an employer 2.14 euros for the employee to be paid 1 euro net. France dropped to second place, with a cost of 2.13 euros, Belgium being next in the ranking, the employer paying 2.10 euros.

At the opposite pole, in Cyprus, an employer pays only 1.33 euros (compared to 1.22 euros last year) for the employee to be paid 1 euro. In Malta and Ireland, an employee paid 1 euro costs the employer 1.38 and 1.35 euros, respectively.

Translated from Romanian by Service For Life S.R.L.